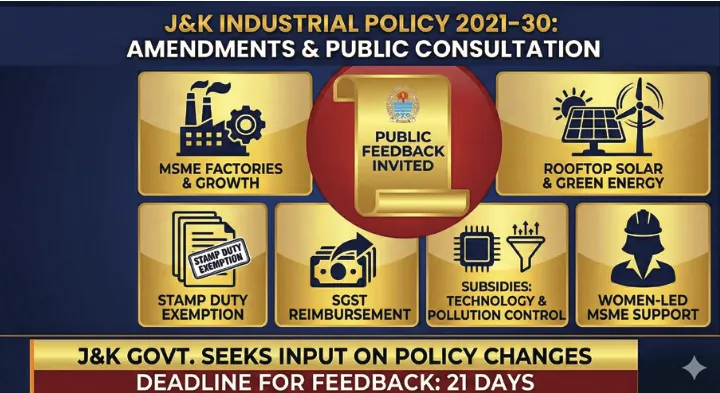

Srinagar, Dec 25: The Jammu and Kashmir government has proposed sweeping amendments to the J&K Industrial Policy 2021–30, inviting public and stakeholder feedback on a new set of incentives aimed at strengthening industrial growth, promoting green energy and providing enhanced support to MSMEs across the Union Territory.

In a public notice issued on December 23, the Industries and Commerce Department said it “contemplates to revisit the J&K Industrial Policy 2021–30 to introduce new incentives and benefits, based on best practices prevailing in various States/UTs, while having regard to specific needs of the region.”

The department has placed the proposed incentives in the public domain through a notice and has invited suggestions from “industry associations/trade bodies, businesspersons, entrepreneurs, industry experts, academia, civil society, etc. and the general public” within a period of 21 days.

As per the proposal, the government plans to promote cleaner industrial activity by encouraging renewable energy adoption. The notice states that the government shall permit “rooftop solar with net metering and Green Open Access, by providing incentives including a 25% capital subsidy (up to Rs 25 lakh), and waiver of open-access charges to encourage widespread adoption of renewable energy across Industrial Estates.”

On statutory relief, the policy proposes that “new units and existing units undertaking substantial expansion shall be eligible for 100% exemption of Stamp duty on land transactions in Government Industrial Estates, including lease deed and mortgage deed.”

The document also enhances support for quality and compliance certifications. It notes that the government shall provide “100% reimbursement of the cost of obtaining recognised certifications… subject to a maximum ceiling of Rs 10 lakh per enterprise,” covering labour, sustainability and quality management certifications.

For MSMEs adopting new technology, the proposal states that “for MSME – 50% of the cost subject to maximum of Rs. 25 lakh for adopting technology from a recognised National Institute.” It further adds that units investing in pollution control will be eligible for subsidy “@ 60% of the cost of Pollution Control Devices, subject to a maximum of Rs. 50 lakhs.”

The policy places significant emphasis on environmental protection, proposing “50% subsidy (Max Rs 50 lakhs) on the expenditure incurred on installation of new equipment of Green Building, Circular economy, rainwater harvesting, wastewater recycling, zero discharge process/solid waste management or any other green measure certified by JKPCB.”

On fiscal incentives, the draft policy proposes that the government shall “reimburse 100% SGST paid by eligible industrial units for 5 years,” subject to ceilings linked to fixed capital investment, enterprise size and zone.

The document also outlines higher capital investment incentives for MSMEs, with Zone A units eligible for “30% financial assistance, subject to a ceiling of Rs 50 lakh,” while Zone B units may receive “50% financial assistance, subject to a ceiling of Rs 1 Cr.” It adds that “women-led MSMEs (at least 51% Stake) across all zones may be provided 25% extra financial assistance.”

In a bid to promote innovation, the proposal offers “100% of actual filing costs on awarded patents, subject to a maximum of INR 2 Lakhs for domestic patents and INR 5 Lakhs for international patents.” Sick units identified under RBI norms will also be supported, with the notice stating that such units “will receive the same incentives as new industrial units under the current policy.”

The government has further proposed an additional incentive, noting that it shall provide “an additional incentive equivalent to 1.25 times the eligible amount for units operating in the focus sectors.” Units listed on recognised stock exchanges will be eligible for reimbursement, with the policy stating that “an incentive of Rs 50 lakh shall be reimbursed to any industrial unit registered in the Union Territory of J&K that successfully lists its equity on a recognised stock exchange in India.”

For MSMEs, the policy reiterates the provision of a single approval mechanism, allowing new units to obtain a “Certificate of In-Principle Approval” based on self-declaration, followed by a three-year grace period to secure all necessary clearances.

The notice also defines mega projects as those with a minimum capital investment of Rs 4,000 crore and states that the government may extend “tailor-made incentives deemed necessary for the project” through the single-window portal.

Calling for public participation, the department said stakeholders are requested to “review the proposed incentives contained in the enclosed Annexure ‘A’ and furnish their valuable suggestions/comments/inputs thereon within a period of twenty one (21) days from the date of publication of this notice.” It cautioned that “any suggestion/inputs/comments received after the last date shall not be taken into consideration.”

The complete notice and annexure have been uploaded on the department’s official website.